Paytm is finally going all out and is being converted into a digital banking solution on May 23. We earlier reported that the leading digital wallet provider had received initial approval from the Reserve Bank of India (RBI) to set up its Paytm Payments Bank in the nation. But, the financial regulatory body has now awarded Paytm with the final licence required to set up its banking service and the same is going live next week.

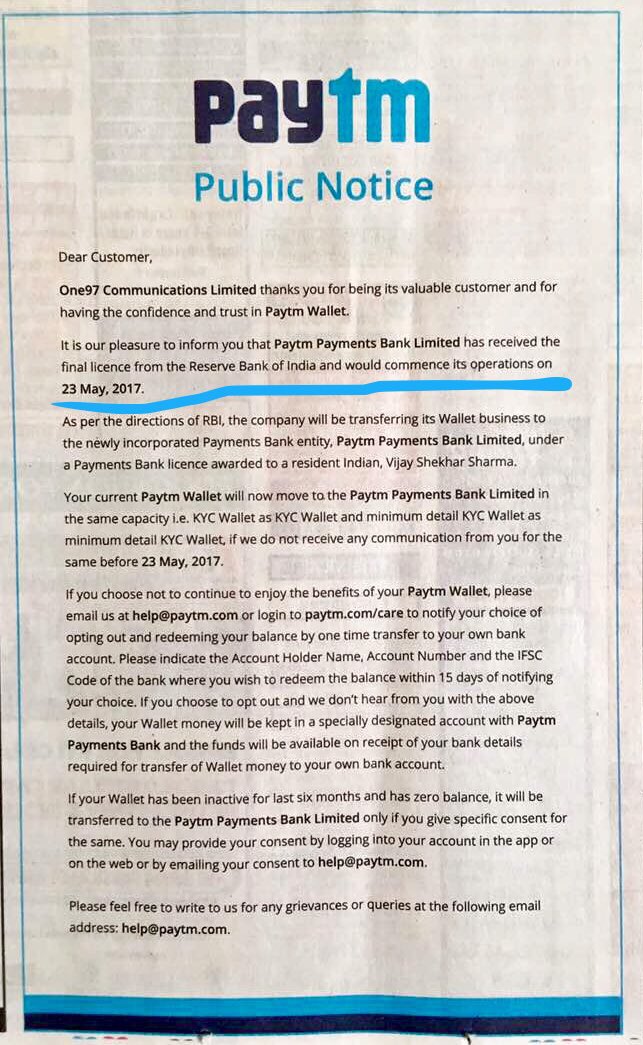

The company’s elated chief executive, Vijay Shekhar Sharma shared this development on his Twitter profile. Paytm Payments Bank is coming to life has already made to the masses through a full-page advert released (screenshot attached underneath) in most of the country’s newspapers. Here is the tweet shared by him:

In addition to making us aware of the official launch date, the advert also sheds light on the basic details of how the process of transferring the digital wallets to Paytm Payments Bank will occur in the coming days. As RBI’s guidelines define that a digital payments solution provider will have to transfer the waller business to the new banking entity.

But, it’s not like you aren’t being provided a choice by the Alibaba-backed company. Paytm Payments Bank is not forcing you to become a part of the digital payments revolution. You have the option to opt out from the said change but you will lose access to your Paytm wallet as well. Now, don’t be utterly surprised. We’ve already mentioned above that Paytm wallet accounts would be transferred to the banking entity next week.

The newspaper advert reads:

Your current Paytm Wallet will now move to the Paytm Payments Bank Limited in the same capacity i.e KYC wallet as KYC wallet and minimum detail KYC wallet as mimimum detail KYC wallet, if we do not receive any communication from you for the same before 23 May, 2017.

You can opt-out from the banking service by making Paytm aware of your choice and providing the team with your bank account details for a one-time chance to redeem all your balance. You can exhaust the balance before your wallet is transferred to Paytm Payments Bank Limited, else the total will be stored in a common pool at the bank — until you provide your bank account details.

This development comes on the heels of the massive ₹218 crores (or $32.5 million) cash infusion into the Paytm Payments Bank platform. As per regulatory filings, the investment comes from Paytm CEO Vijay Shekhar Sharma, who is leading the investment with a sum of ₹111 crores. While the remaining investment of Rs.107 crore comes from One97 India Communications, the parent company for Paytm. All this capital has, however, made it to the company’s coffers, thanks to Chinese e-commerce giant Alibaba.

Now, Paytm Payments Bank will be able to provide a majority of the services offered by traditional banks — but digitally. This will enable the company to further financial inclusion in India. The spin-off financial platform is also planning to sell products such as loans, insurance, & wealth management in order to drive revenues. There have also been speculations that Paytm is working on its own debit card-like service to help users in remote areas to also gain access to the Payments Bank. We’ll have more information on how the same will work in the coming days.

EmoticonEmoticon